|

Consider the importance of pricing:

Your product's price is normally highly visible, particularly as an “easy” comparative measure in competitive markets.

It can be a powerful signal of either quality or value.

It can therefore significantly affect your image, acceptability or credibility within your product category.

In some circumstances, it can be used very effectively as a competitive weapon.

And it has a major influence on the volume of sales you are likely to achieve, and thus influences both sales revenue and profit.

So, is the price right?

Theoretically it’s quite easy: The right price is the price which maximises your revenues. In reality, however, it’s tricky to find that exact level.

Having unique products helps

Industrial and business-to-business markets are distinct from consumer markets in that they tend to be much more complex.

Firstly, you’d really need to distinguish between commodities and value-added products. For commodities, price elasticity is very high: a slightly higher price results in far less units sold - and vice versa. For value-added, or highly differentiated, products you very often find that the demand is almost inelastic: you can substantially increase price without a noticeable decrease in the volume sold.

That’s why it helps having unique products (and/or services) if you want to increase your prices - and profits, as demand will be affected less.

So far pretty clear, but do you equally have full knowledge about how your target group perceives your products? Are they thought of as a commodity or do you truly have a differentiated, value-added, product that makes it possible for you to charge a (much) higher price than today?

Why not find out?

Using intelligent research to take intelligent decisions

Let’s be frank about this: pricing analysis is probably one of the most difficult kind of marketing research. That’s because it relies on the customers’ predictions of what their own possible actions would be if a price increase or decrease were to take place.

The big question is whether, at the end of the day, they’ll put their money where their mouth is. However, it is possible to overcome most of the problems associated with pricing research.

Over the years three main techniques have been developed which help marketers make intelligent pricing decisions:

1. Price Sensitivity Measurement (PSM)

2. Trade-off grid

3. Conjoint Analysis

Price Sensitivity Measurement - “quick & dirty”

This technique was developed by psychologist van Westendorp. It’s really a quite simple approach, because all it takes is for the respondents to answer four simple questions about the product or service:

1. At what price would you consider this product/service to be cheap?

2. At what price would you consider this product/service to be expensive?

3. At what price would you consider this product/service to be too cheap?

4. At what price would you consider this product/service to be too expensive?

It’s as simple as that. As long as the price range is realistic, the answers make it possible to draw some quite interesting conclusions concerning your pricing. Let’s take a look:

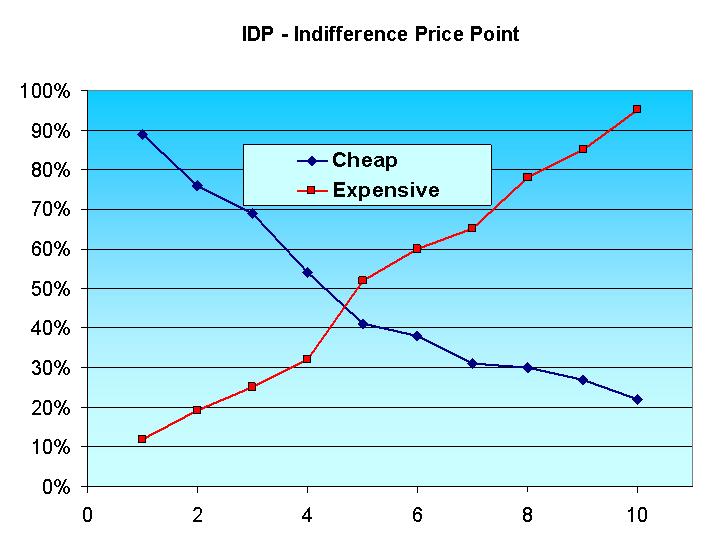

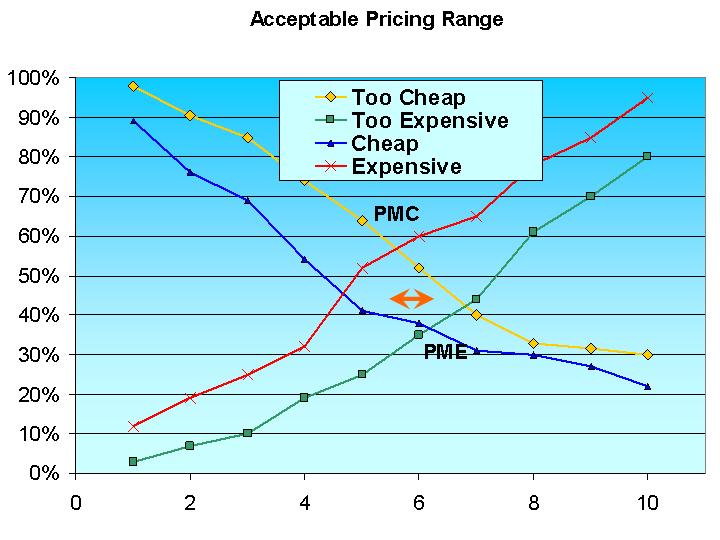

Indifference Price Point (IDP – “cheap” vs “expensive”):

This is where the number of respondents who regard the price to be cheap is equal to the number of respondents who regard the price to be expensive. This generally represents either the actual median price or the market leader’s price.

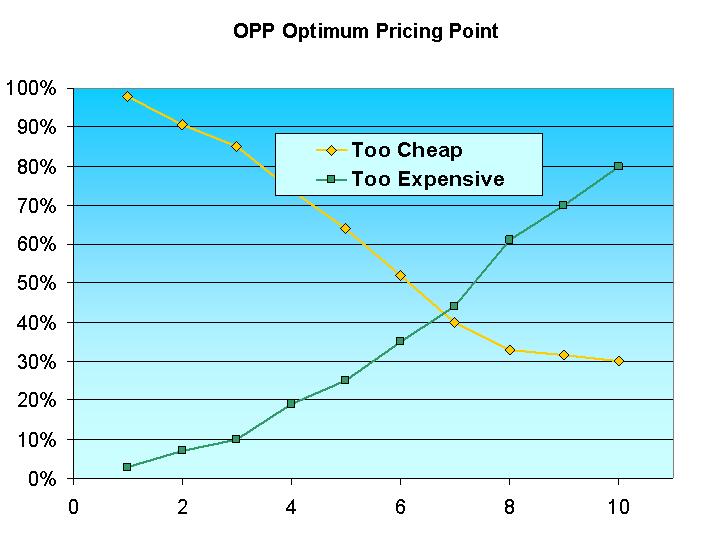

Optimum Pricing Point (OPP – “too cheap” vs “too expensive”):

This is the price level at which the percentage of customers who see the product as being too cheap is exactly the same as the percentage of customers who see the product as being too expensive. This is generally considered to be the recommended price.

Point of Marginal Cheapness (PMC – “too cheap” vs “expensive”):

This is the point where the number of customers that find the product too cheap equals the number that find the product expensive. This is the lowest “accepted” price level.

Point of Marginal Expensiveness (PME – “cheap” vs “too expensive”):

This is where an equal number of customers find the product cheap and too expensive respectively. This is typically the highest achievable price level.

Range of Acceptable Pricing (RAP):

The range of prices between the Point of Marginal Cheapness (PMC) and the Point of Marginal Expensiveness (PME) comprises the price range that the market generally is going to accept - and you will most likely find very few products priced outside this range.

The trade-off

Most people realise that, in real life, you can’t have everything, i.e. the highest level of specifications at the lowest level of price. And if you don’t want to become a commodity seller, you’ll need to find a way to differentiate your products.

But how should you feature your product?

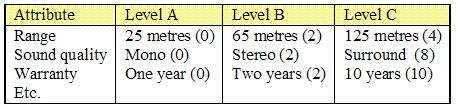

You can identify product structure through a trade-off grid where the customer is forced to make a number of trade-offs. This makes it possible to prioritise features and distinguish between what customers must have and what is merely nice-to-have.

Any given product consists of a number of characteristics (size, colour, speed, etc.) at different levels (small, medium, large, red, yellow, green, slow, fast, etc.). These attributes at different levels are shown in a grid with the lowest levels of each attribute to the left increasing to higher levels towards the right hand side of the grid. The grid is then presented to the customer who is asked to allocate 100 points.

You can then discover a number of interesting things, such as:

What do customers find to be the ideal standard?

How do customers place “you” on the grid?

How would customers prioritise different improvements?

If customers had more of attribute X, what would they be willing to sacrifice?

The customers’ distribution of points expresses the trade-offs. This allows you to see what you could do to increase sales (and more interestingly, at what price).

In other words, the result gives you a detailed understanding of where the customers would like improvements, what those improvements should be and what they are willing to pay for them.

Conjoint analysis

If you want to take the trade-off analysis a few steps further, you can consider a conjoint analysis.

Let’s look at a very simplified example – an office copier with three features:

Each of these attributes has a number of levels:

Warm-up: 2 minutes or 5 seconds

Pages per minute: 6 or 20

Price: £500, £750, or £1,000

In this simplified example you can “build” a total of 12 combinations (2 x 2 x 3) of different machines by choosing one level for each of the three features, for example

Model A

Warm-up: 2 s

Pages: 6 PPM

Price: £500

Model B

Warm-up: 5 s

Pages: 20 ppm

Price: £750

“Which one of the two alternatives would you choose”?

That’s what the respondents would be asked. When they have answered they get a new pair of combinations from which to choose. This continues until the respondents have looked at and compared all meaningful combinations of attributes.

Based on this vast amount of data it’s possible to not only find the optimum price, but also the optimum level of each of the other attributes.

Great for new products

This is particularly interesting and useful when you are developing brand new products because it's always difficult to decide how to specify the product and at which price to sell it. A conjoint analysis can help you.

It doesn’t have to break the bank

It’s what you need to know that should determine your choice of method.

If you “just” need to find the optimum price for an existing product go for the Price Sensitivity Measurement.

If you want to get a good indication of what it takes to differentiate your product in a way that is valuable to your customers, use a Trade-off grid analysis.

If you need the full package where you can calculate your way to an optimum product at an optimum price, consider conjoint analysis.

Regardless, remember that the value of these analyses far outweighs the cost of not doing them and ending up having a “random” price.

Get more info now:

At LEC Clarity, we have helped companies find out how to identify the best price level and improve their marketing in the UK and internationally.

If you'd like to know more about how we do this, and how we might be able to help you, just call us now at 0870 745 6899 or fill in the form below to arrange an initial free-of-charge consultation:

Go to overview of Clarity Techniques

Go to Clarity Cases in point

|

|